How To Get Challan Details Of Tds

Steps for tds challan verification [procedures & conditions for correction] Tds challan correction How to generate challan form user manual

Steps for TDS Challan Verification [Procedures & Conditions for Correction]

View client details (by eris) > user manual How to download tds challan How to add tds challan to statement

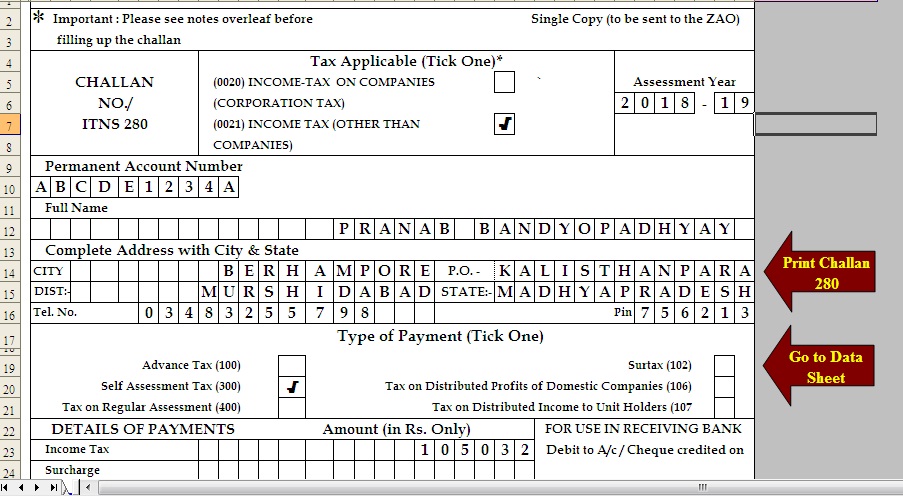

Free download tds challan 280 excel format for advance tax/ self

How to check tds challan status onlineIncome tax challan fillable form printable forms free online Procedure after paying challan in tdsE-tds return file| how to download tds challan (csi) from income tax.

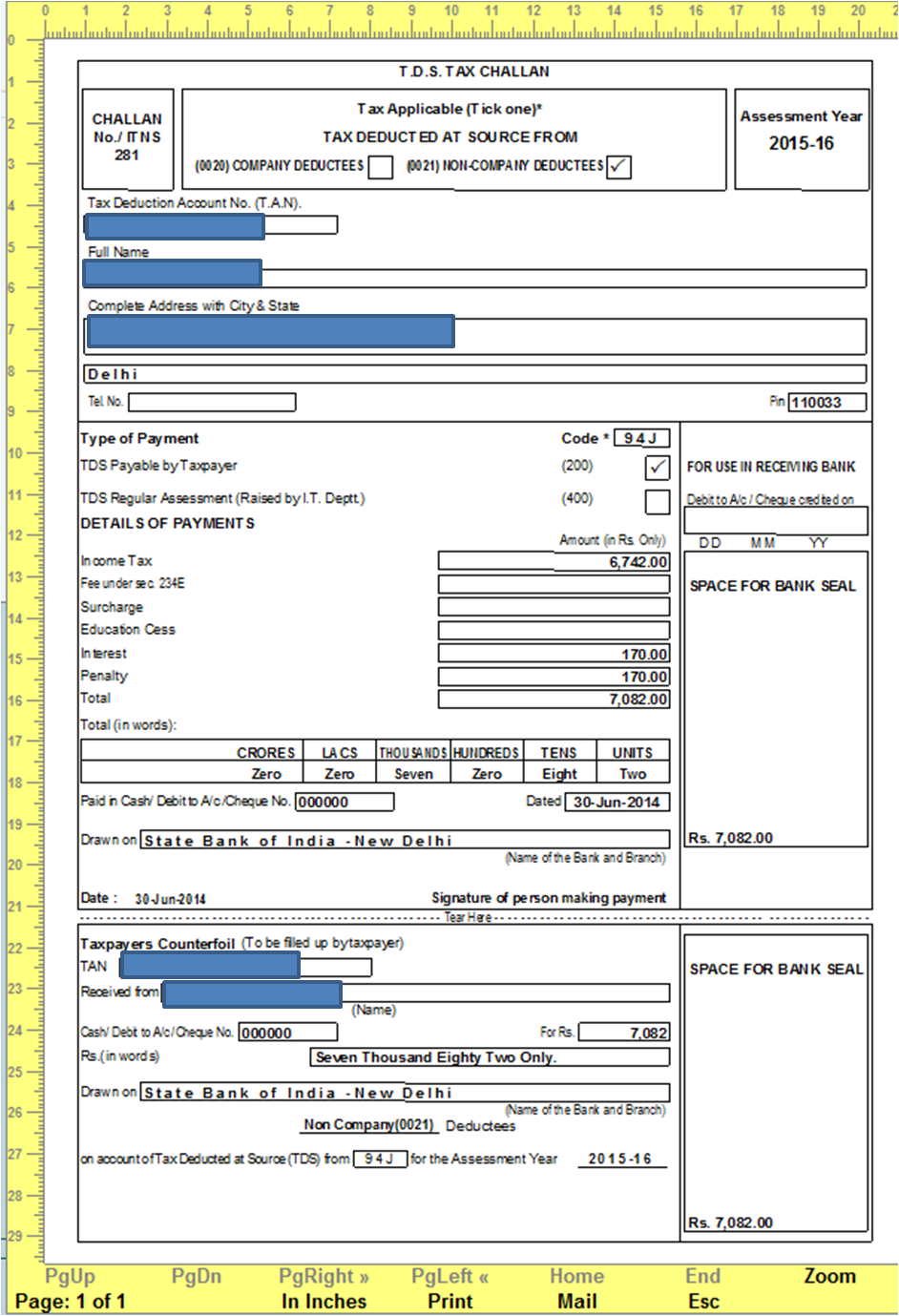

Tds challan 281 excel format wordHow to e-challan online payment How to download tds challan and make online paymentHow to download tds challan from online?.

How to download tds challan and make online payment

How to make changes in the tds challan details paid online or offlineHow to download tds challan from online? How to download tds challan from online?Challan 280 in excel fill online printable fillable b.

Simple steps to add challan details via gen tds softwareChallan tds Add challan to statement onlineHow to check the tds/tcs challan status claimed and unclaimed on the.

Challan tds verification

Challan tds status check online nsdl steps easyHow to check tds challan status on online How to download paid tds challan and tcs challan details on e-filingTds challan correction incorrect offline modifications gstguntur entered furnished assessment.

Tds payment challan excel format tds challana excel formatTds payment How to correct tds challan if paid through e filing portalSteps for tds challan verification [status inquiry and correction].

Tds challan 281 excel format

How to download tds challan from online?Tds challan paying salary computation Tds challan chequePnb tds challan download.

Tds challan status check online, verify tds challan details.Tds excel challan signnow pdffiller Tds challan statusChallan tds interest penalty lesson create tally erp9 printout done its get.

![Steps for TDS Challan Verification [Procedures & Conditions for Correction]](https://i2.wp.com/saral.pro/wp-content/uploads/2023/02/How-to-Verify-a-Paid-Challan-in-TDS.png)

Lesson-47 how to create tds interest/penalty challan in tally.erp9

.

.

.jpg)

Procedure after paying challan in TDS - Challan Procedure

How to correct Tds challan if paid through e filing portal | TDS

How to Download TDS Challan From Online? | How Can I Get Duplicate

E-Tds Return File| How to Download Tds Challan (CSI) from Income Tax

Free Download TDS challan 280 excel format for Advance Tax/ Self

Lesson-47 How to Create TDS Interest/Penalty Challan in Tally.ERP9

How to add TDS Challan to Statement | Adding TDS challan